- Why use Exness calculator?

- The main features of Exness calculator

- How to use Exness calculator

- The skill of accurate calculation

- Understand the results of the Exness calculator

- Using Exness Trading Calculator for Risk Management

- Compare different trading scenarios

- Frequently Asked Questions about Exness Calculator

Why use Exness calculator?

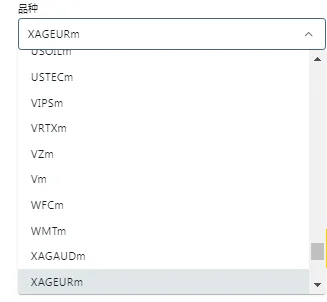

Exness trading calculator is an essential tool in trading. It will perform important calculations before you trade, including margin, point value, and potential profits or losses. This makes your trading plan easier.

Using the Exness calculator is a wise choice for any trader. This calculator will save you time and provide accurate calculations, thereby reducing your trading risk.

The main features of Exness calculator

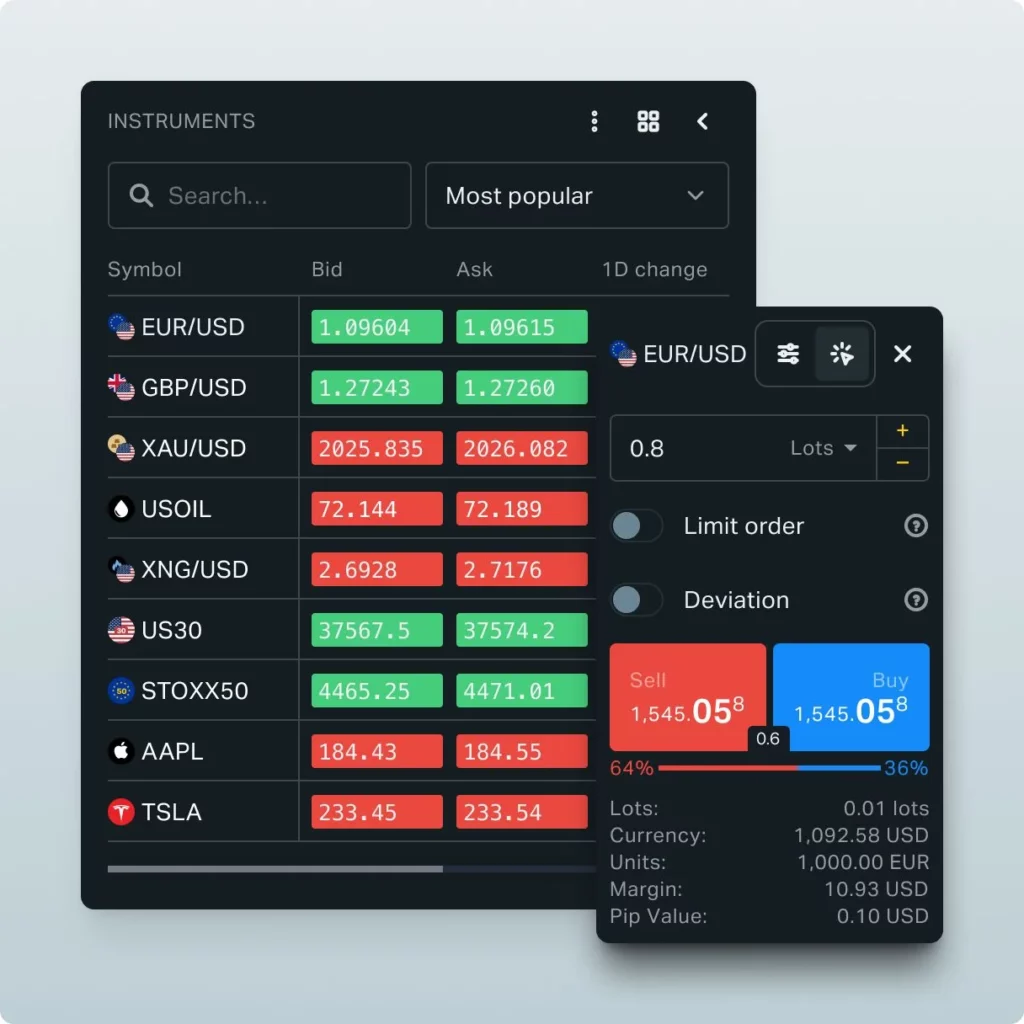

Exness The trading calculator has many practical functions. The following are the main features:

- Wide range of computational parametersThe calculator will consider various factors such as account type, trading instruments, lot size, and leverage to provide you with accurate results.

- User friendly interfaceThis dashboard is designed to be easily accessible to anyone, from novice traders to advanced users.

- Instant ResultThe result of the transaction is displayed in real-time, including potential profit, required margin, point value, and swap rate.

- risk managementAllow you to see the risks of each operation and develop plans to minimize losses.

- Customizable inputUsers can change input parameters according to their trading style and needs.

Calculation Parameters

To obtain accurate results, you need to understand the parameters used in the Exness calculator. The following are the key parameters:

- Account TypeDifferent accounts have different rules. Understanding your account type can help with accurate calculations.

- Trading ToolsThis is the object of your transaction, such as currency pairs, commodities, or indices.

- Hand sizeThis is the scale of your transaction. It will affect your margin and potential profits or losses.

- leverThis is the amount of funds you borrowed for trading. Higher leverage may imply higher risk.

- bid and askedThis is the price at which you can buy or sell trading instruments.

How to use Exness calculator

Using the Exness calculator is very simple and can help you make informed trading decisions. Here are ways to effectively use it.

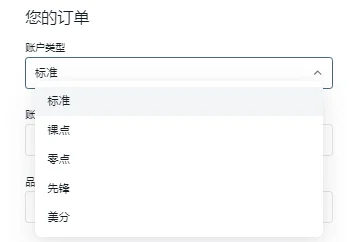

Select account type

first,Choose your account typeExness offers multiple options,Including standard accounts、Professional accountOriginal spread account and zero account. Each account type has different trading conditions, such as spreads and commissions, so choosing the right account type is crucial. For example, if you are using a raw spread account, please select it in the calculator to obtain accurate results that best fit your trading environment.

Choose trading tools and lots

Next, select the trading tool and lot size. The Exness calculator supports a wide range of trading tools, such as forex currency pairs (such as EUR/USD), metals (such as XAU/USD, gold), and cryptocurrencies (such as BTC/USD, Bitcoin). After selecting the trading tool, enter the number of lots you intend to trade. For example, if you plan to trade 0.5 lots of XAU/USD, please enter "0.5" in the lots field.

Set leverage

The choice of leverage depends on the leverage ratio you wish to use. You can specify the leverage ratio for the trading account. For example, if your account leverage is 1:200, please enter this value in the leverage field. The level of leverage you use will determine the required margin and the profit or loss gained from trading.

Calculation results

After providing all the information, click 'Calculate' now to obtain the results. The calculator will provide you with key data such as required margin, point value, and potential profit or loss. For example, if you trade 1 lot of EUR/USD with leverage higher than 200 times, the required margin for opening a position may be $500. It will also display the point value, which reflects the profit or loss brought by the fluctuation of each point in the market.

The skill of accurate calculation

To achieve optimal performance of the Exness calculator, please follow the following guidelines:

- Confirm input: Before pressing the enter key, always ensure that your account type, trading instrument, lot size, and leverage are entered correctly. Minor but significant errors may lead to inaccurate results.

- Real time market price: When calculating costs, please use the current market price to keep pace with the market. Market volatility is high, and updated data is crucial.

- Understanding Parameters: Understand the role of each parameter and how it affects your calculations. This will help you make better trading decisions.

- Enter actual data: Enter actual data that matches your trading strategy and goals. Avoid entering extreme values that do not represent your trading plan.

- Analysis results: Carefully check the calculation results. Verify whether the detailed information of potential profits, margin, etc. meets your expectations and strategies.

Understand the results of the Exness calculator

When you use the Exness calculator, you will receive important information about trading. Here is a quick guide to the results:

bond

Margin is the initial amount you must invest, which accounts for a small portion of the total transaction size. When using any leverage, this calculator calculates the required margin for your account type and lot size dimension. This helps you understand how much funds need to be reserved for trading.

Spread cost

Spread cost is the difference between the buying price and the selling price, which can be considered as a trading fee. Every transaction incurs a spread fee, which will be displayed in the calculator to help you understand the cost of conducting a specific transaction.

commission

Commission is the fee that brokers may charge for each transaction. The Exness calculator will inform you if there are commission fees and what the rates are. Understanding this will help you understand the total cost of the transaction.

Swap fees (long and short positions)

Swap fee is the interest expense on overnight positions. The buying transaction is a long position swap, and the selling transaction is a short position swap. The swap rate (both cost and benefit) will be displayed in the calculator. This helps you understand whether you need to pay or receive interest when holding overnight positions.

Point value

Point value is the amount you earn or lose for every point change in price. The calculator calculates the point value based on your lot size and trading tools. Understanding point values can help you grasp the potential profit or loss situations in trading.

Using Exness Trading Calculator for Risk Management

The Exness trading calculator is very useful in managing trading risks. It helps you understand possible situations before conducting transactions. Here are how it can help you:

- Plan your transactionYou can try different settings to see how changes affect your transactions. This helps you plan better.

- Set stop loss and take profitCalculator enables you to set stop loss (limit losses) and take profit (lock in profits) as well as possible. This can better protect your funds.

- Understand risk/rewardIt helps you decide whether to trade based on potential risks and returns. This helps you conduct wiser and safer transactions.

Compare different trading scenarios

Understanding how specific trading scenarios affect your income is crucial for decision-making. With the help of a calculator, you can consider various situations.

Imagine you are trading the EUR/USD currency pair, but with different leverage and lot sizes:

| parameter | Scenario 1 | Scenario 2 |

| Trading Tools | EUR/USD | EUR/USD |

| LOTS | 1 hand | 0.5 hand |

| lever | 1:100 | 1:500 |

| Account Type | Standard account | Professional account |

| NECESSARY MARGIN | $1,000 | $100 |

| Point value | $10 per point | $5 per point |

| Potential profit/loss | $100 fluctuation every 10 points | $50 fluctuation every 10 points |

scenario

In scenario 1, you use a 1:100 leverage to trade 1 lot of EUR/USD on a standard account. The required margin for this transaction is $1000, with a volatility value of $10 per point. This means that every time the market fluctuates by 10 points, your profit or loss will be $100.

In scenario 2, you use a high leverage of 1:500 to trade 0.5 lots of EUR/USD on a professional account. In this case, the required margin is reduced to $100, with a value of $5 per point. Therefore, whenever the market fluctuates by 10 points, your profit or loss will be $50.

Comparison of Results

The leverage and lot size choices in these scenarios demonstrate how trading affects your trading results. Higher leverage means lower margin. Fewer lots mean less profit, but at the same time, it also reduces risk. By changing these parameters, you can use the Exness calculator to find the results of different trading scenarios and make wiser trades.

Frequently Asked Questions about Exness Calculator

How to use Exness calculator to calculate margin?

Just enter your account type, trading instrument, lot size, and leverage. The calculator will tell you the required margin amount for this transaction.