Exness is renowned for its transparent fee structure and competitive pricing. Understanding platform trading related fees is crucial for traders to effectively manage their trading costs. This guide will delve into the various types of fees you may encounter when trading with Exness, including spreads, commissions, overnight swap fees, deposit and withdrawal fees, inactivity fees, and more. The following table has been expanded for each category, providing detailed insights.

The main categories of Exness expenses

Exness charges different types of fees based on assets, account types, and trading conditions. Below, we will provide a detailed introduction to the different types of fees that affect traders.

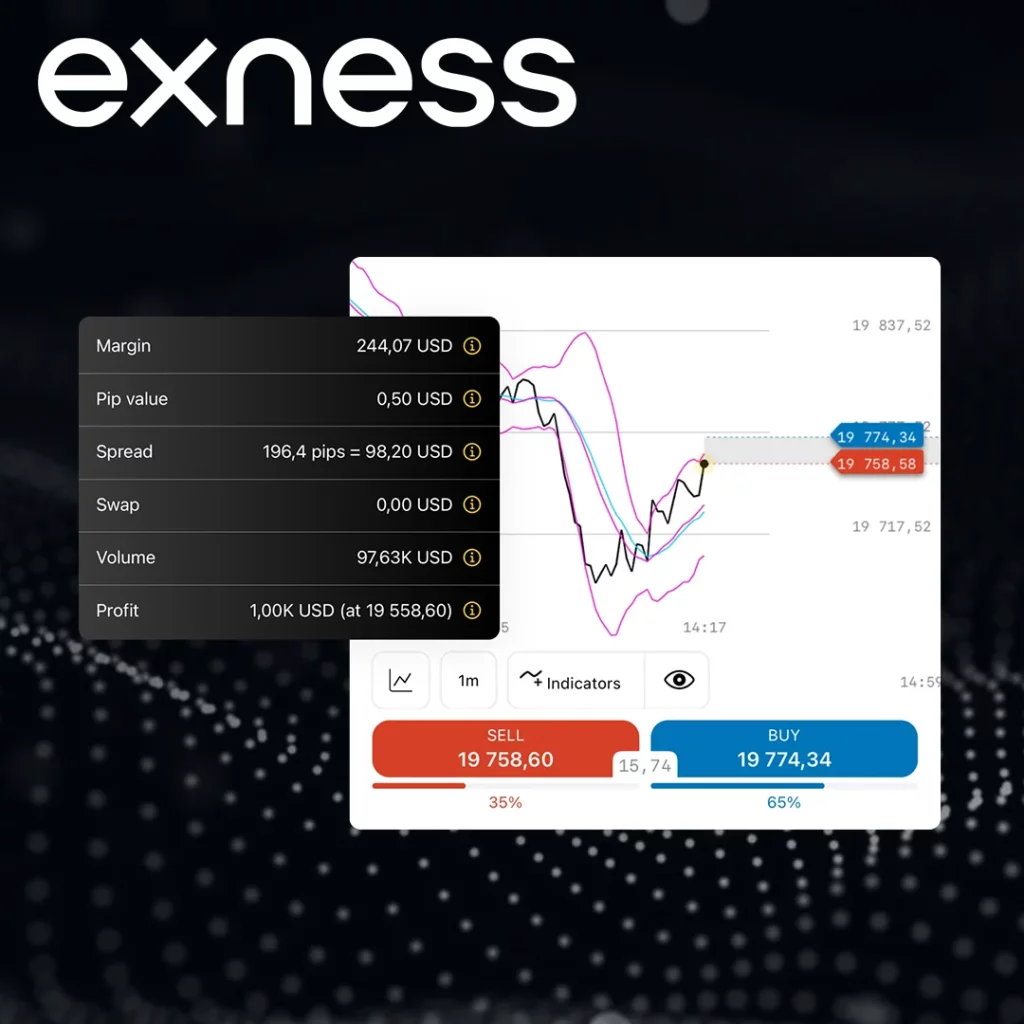

Spread and commission

Spread is one of the most important costs for traders. Exness provides fixed and floating options based on account typeSpreadIn addition to spreads, some accounts charge commissions for each transaction, especially for high-frequency traders.

| Account Type | Spread type | Euro/US Dollar Spread (Standard) | commission | Additional explanation |

| Standard account | fixed | 1.0 point | 无 | Most suitable for beginners and infrequent traders |

| Professional account | variable | Starting from 0.1 o'clock | 无 | Suitable for more active traders |

| Zero account | fixed | 0.0 point | $3.50 per lot | Low point spread suitable for high-frequency traders |

| Original spread account | variable | Starting from 0.0 o'clock | $3.50 per lot | The most suitable for scalpers and traders who value low spreads |

- Standard account:For beginners, fixed spreads are easier to manage. Trading does not charge any commission, which is very suitable for those who do not trade frequently.

- Professional account:Variable spreads provide flexibility in trading. Suitable for traders who want to find a balance between costs and trading conditions.

- Zero account:Low fixed spread, but each transaction includes commission, suitable for high-frequency traders.

- Original spread account:Commission based original spread - suitable for scalping trades and traders aiming to capture small price fluctuations.

Overnight fee (swap fee)

Overnight fees, also known as swap fees, are fees charged when you hold a position overnight. These fees are based on the interest rate difference between the two currencies you are trading.

| Asset Class | Swap long position fee | Swap short fee | Overnight fee | Additional explanation |

| foreign exchange | change | There have been changes | unchanged | Affected by market conditions and currency pairs |

| goods | change | There have been changes | different | The cost can be positive or negative, depending on the interest rate |

| stock | different | There have been changes | indefinite | Fees will fluctuate with market performance |

| Cryptocurrency | change | There have been changes | There are differences | Due to volatility, swap fees may be higher |

- Foreign exchange swap fees:These fees will vary depending on currency pairs and market conditions. They can be positive or negative, depending on the difference in interest rates.

- Commodities and Stocks:The cost of exchanging commodities and stocks depends on market conditions and the overall trading environment.

- Cryptocurrency exchange fees:Due to the high volatility of cryptocurrencies, their exchange fees may be higher than other assets.

Deposit and withdrawal fees

Exness offers multiple deposit and withdrawal methods. Most of these are free, but some methods may incur small fees, especially when using third-party services.

Deposit fees

Exness allows you to deposit through various methods, such as bank transfers, credit/debit cards, e-wallets, and moreCryptocurrency。

| Deposit method | cost | processing time | Minimum deposit amount | notes |

| bank transfer | free | 1-3 working days | $10 | Some banks may have longer processing times |

| Credit/debit card | free | immediately | $10 | Instant deposit available |

| e-Wallet(Writers, Netizens etc.) | free | immediately | $10 | Quick and convenient deposit |

| Cryptocurrency | free | immediately | $10 | No third-party fees involved |

- bank transfer:Although Exness does not charge any fees, third-party fees may be incurred and processing times may take 1-3 business days depending on the bank.

- Credit/debit card:Deposits will be processed immediately and Exness will not charge any additional fees.

- Electronic wallet:Skrill and Neteller offer instant deposits, while Exness does not charge any fees, but third-party service providers may charge fees.

- Cryptocurrency:Depositing with digital currencies such as Bitcoin or Ethereum is free and can be processed instantly without any third-party fees.

Withdrawal fee

Exness offers multiple withdrawal options, including bank transfer, electronic wallet, and cryptocurrency. Most withdrawal methods are free, but in some cases there may be third-party fees.

| Withdrawal method | commission | processing time | Minimum withdrawal amount | precautions |

| bank transfer | Free (may require payment of third-party fees) | 1-3 working days | $10 | Banks may charge transaction fees |

| Credit/debit card | free | 1-3 working days | $10 | Withdrawals may take 1-3 business days |

| e-Wallet(Writers, Netizens etc.) | free | immediately | $10 | Exness Quick Withdrawal, No Transaction Fees |

| Cryptocurrency | free | immediately | $10 | Instant processing, no additional fees |

- bank transfer:Exness does not charge any fees, but some banks may charge fees for processing withdrawals.

- Credit/debit card:The withdrawal fee is free, but the processing time can take up to 3 working days.

- Electronic wallet:Withdrawals through Skrill and Neteller can usually be processed instantly without any withdrawal fees.

- Cryptocurrency:Withdrawals are free and processed immediately without any additional fees.

other expenses

In addition to transaction related fees, Exness may also have other fees that may apply in specific circumstances, such as inactivity fees and currency exchange fees.

| Expense Type | amount of money | condition |

| Idle fee | 0 USD -10 USD per month | Charged when there is no trading activity for more than 6 months. |

| Manual account fees | Apply for $10-50 each time | Applicable to any manual intervention request (such as withdrawal). |

| Currency exchange fee | 0.5% – 2.0% | Deposit and withdraw funds in currencies other than the basic currency of the account. |

- Account inactivity fee:If there is no trading activity for more than 6 months, Exness may charge a small inactivity fee. This fee is usually low, but can be avoided by keeping your account active.

- Manual account fees:Exness charges a small fee for operations that require manual intervention, such as withdrawals or personal processing.

- Currency exchange fee:When the currency used for deposit or withdrawal is different from the base currency of your account, Exness will charge a certain currency exchange fee.

Comparison of Exness and other broker fees

A clear method to evaluate the competitiveness of Exness fees is to compare them with other brokers in the market. Here is a detailed comparison of key fee categories for some leading brokers.

| broker | Account Type | Minimum deposit amount | Spread (Euro/USD) | commission | Withdrawal fee | Currency exchange fees |

| Exness | Standard, professional, zero, original price difference | $10 | 0.0 points (original spread) | $3.50 per lot (zero spread/original spread) | Free (depending on the method) | 0.5% – 2.0% |

| Toro | Standard, Professional | $200 | 1.0 point | 无 | Free (Limited) | 0.5% – 2.0% |

| IG Markets | Standard, Professional | $300 | 0.7 points | $2 per lot | $15 per withdrawal | 1.0% – 3.0% |

| Plus500 | standard | $100 | 0.6 points | 无 | Withdraw $50 each time | 1.0% – 2.5% |

- Exness:Provide competitiveSpreadThere is no withdrawal fee and the exchange fee is extremely low.

- Area:Require a higher minimum deposit and a spread of 1.0 point. It charges conversion fees for currency exchange.

- IG Markets:Although they offer tighter spreads, they require higher minimum deposits and have withdrawal fees.

- Plus500:Compared to Exness, it is known for charging higher withdrawal fees.

conclusion

Exness offers a transparent and competitive fee structure that is suitable for traders of all levels of experience. Exness stands out for its trader friendly approach, offering multiple account types, no deposit fees, and diverse withdrawal options. Understanding the different expense categories outlined in the extended table can help you understand transaction costs and make informed decisions for your trading strategy.

Trade immediately with trusted broker Exness

Personally understand why Exness is the preferred broker for over 800000 traders and 64000 partners.

Frequently Asked Questions (FAQs)

What is the minimum deposit amount for Exness?

The minimum deposit amount depends on the account type, with some accounts requiring as low as $10.