When comparing Exness and XM, two leading forex brokers, it is clear that both can meet a wide range of needs from beginners to professional traders. Each broker offers unique features, and understanding these differences can help you make informed choices based on your trading style and goals.

Regulation and Safety

Exness and XM are both strictly regulated to ensure a secure trading environment. Exness holds licenses from top regulatory agencies, including CySEC, FCA, and FSCA, providing strong customer fund protection measures, including segregated accounts and negative balance protection. On the other hand, XM is regulated by multiple regulatory agencies including CySEC, ASIC, and FSC, providing similar safeguards.

Although both brokers meet high standards of regulatory requirements, Exness stands out with its smooth negative balance protection mechanism across all accounts, providing traders with additional security during market fluctuations.

trading platform

Exness and XM rely on industry standard platforms MT4 and MT5 to ensure that traders have access to powerful tools and features. Exness has added an additional layer of flexibility through its web terminal, allowing users to conduct transactions directly from their browser without downloading.

XM supplements its platform services with its proprietary XM App, providing users with additional analysis and mobile trading capabilities. Although both brokers have performed well in platform support, Exness' web terminal provides a unique advantage for those seeking browser based trading.

Account type and accessibility

The account types offered by these two brokers are suitable for traders of all levels of experience. Exness offers standard accounts, standard enhanced accounts, original spread accounts, zero spread accounts, and professional accounts, with a minimum deposit amount as low as $1, greatly reducing the threshold for new traders.

XM offers micro, standard, zero and ultra-low spread accounts with a slightly higher minimum deposit amount starting at $5. In addition, XM's micro account is designed specifically for ultra small trading volumes, making it particularly suitable for beginners.

| characteristic | Exness | XM |

| minimum deposit | 1 USD | 5 dollars |

| Professional account | Original spread,零, Professional | Zero, ultra-low point difference |

| No overnight fee option | Applicable to all accounts | Limited selection type |

Exness has become a more flexible broker for traders who want to start with minimal investment or seek diversified professional account options.

Trading Tools

Both brokers offer a diverse range of trading tools, but with slightly different scopes and types.

Exness offers a wide selection of over 100 forex pairs, multiple cryptocurrencies, as well as commodities, indices, and energy. Although XM has comprehensive content, it excels in foreign exchange对The quantity of cryptocurrencies is relatively small, but it compensates by offering a wide range of stocks.

| musical instrument | Exness | XM |

| Foreign exchange | 100+is usually represented as "over 100" or "more than 100" in Chinese. | Over 55 years old |

| Cryptocurrency | Wide selection (BTC, ETH) | Moderate (BTC, ETH) |

| stock | limited | Wide range (1000+) |

For traders focused on forex and cryptocurrency, Exness offers more options, while XM attracts those interested in stocks.

Spread, fees, and trading costs

Both brokers offer competitive spreads, although their structures are slightly different. Exness offers a minimum spread of 0.0 on Raw Spread and Zero accounts, with transaction fees as low as $0.2 per lot. The spread for XM's Zero and Ultra Low Spread accounts also starts at 0.0 points, with a handling fee of approximately $3 per lot.

The cost structure of Exness is slightly more attractive to high volume traders as its professional accounts have lower commissions. In addition, Exness provides free period trading for all accounts, while XM only对This feature is available for specific account types.

Deposit and withdrawal

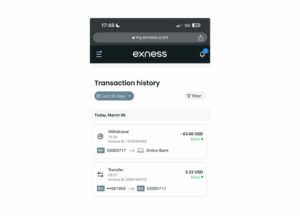

Exness is renowned for its instant deposit and withdrawal processing, providing unparalleled convenience. Most payment methods, including bank transfers, electronic wallets, and cryptocurrencies, can process funds instantly. XM also supports multiple deposit and withdrawal options, but typically takes 24 hours or more to process.

| characteristic | Exness | XM |

| Deposit speed | immediately | Maximum 24 hours |

| Withdrawal speed | immediately | 24 hours or longer |

| Cryptocurrency payment | support | Not Supported |

Traders who require fast fund transfers will find Exness more efficient, especially with its instant processing of deposits and withdrawals.

Customer Support and Education

Both brokers provide excellent customer support, but their availability differs. Exness provides 24/7 multilingual support, ensuring that traders can receive assistance at any time through multiple channels including online chat, email, and phone. XM provides 24/5 email and chat support.

In terms of education, XM stands out with its comprehensive webinars, tutorials, and in-depth market analysis tailored for beginners. Exness places greater emphasis on trading tools such as calculators and economic calendars to empower traders to make informed decisions.

Comparison between Exness and XM

| characteristic | Exness | XM |

| supervise | CySEC (Cyprus Securities and Exchange Commission), FCA (Financial Conduct Authority), FSCA (Financial Conduct Authority of South Africa), FSA (Financial Services Authority) | Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), Financial Supervisory Commission (FSC) |

| Minimum deposit amount | $1 | $5 |

| Foreign exchange currency pairs | 100+ | 55+ |

| Cryptocurrency | Wide selection (BTC, ETH, LTC, etc.) | Limited (BTC, ETH only) |

| stock | Ltd. | Wide range (1000+stocks) |

| platform | MT4、MT5、 Web terminals, mobile applications | MT4, MT5, XM applications |

| Account Type | Standard account, original spread account, zero account, professional account, no swap account | Micro, standard, zero, ultra-low point difference |

| smear | Starting from the original spread of 0.0 and zero account | Starting from 0.0 spread, applicable to zero and ultra-low spread accounts |

| commission | As low as $0.2 per lot (zero account) | $3 per lot (zero account) |

| leverage | Up to 1 | Up to 1:1000 |

| Deposit speed | immediately | Maximum 24 hours |

| Withdrawal speed | immediately | 24 hours or longer |

| SUPPORT | 24/7 multilingual support | 24/5 multilingual support |

| education | Tools like calculators and economic calendars | Extensive webinars, tutorials, and market analysis |

This table highlights the key differences between Exness and XM, helping you make informed choices based on your trading preferences.

Why Exness is a better choice

Exness offers several distinct advantages over XM, making it the preferred broker for many traders:

- Reduce costs:The ultra-low spread and commission make Exness very suitable for active traders.

- Instant trading:Through instant deposits and withdrawals, traders can quickly access their funds.

- A wider range of tools:More than 100 forex pairs and a vast selection of cryptocurrencies provide unparalleled diversity.

- Suitable for beginners:The minimum deposit requirement of $1 ensures accessibility for new traders.

- 24/7 support:24/7 multilingual support ensures assistance is available at any time.

- Flexible account options:Multiple accounts tailored for beginners and professionals.

Final thinking: Exness or XM?

Although Exness and XM are both powerful and reliable brokers, Exness is clearly a better choice for traders seeking low-cost, fast fund transfers, and a wide range of forex and cryptocurrency tools. XM is still a great choice for those who focus on stock trading or looking for rich educational resources.

Ultimately, your choices should be aligned with your trading goals and priorities. For those who value flexibility, efficiency, and diverse trading opportunities, Exness offers an unparalleled trading experience.

Trade immediately with trusted broker Exness

Personally understand why Exness is the preferred broker for over 800000 traders and 64000 partners.

frequently asked questions

What is the comparison between the minimum deposit amount for Exness and XM?

The entry threshold for Exness is very low, with a minimum deposit of only $1, making it very accessible for novice traders. XM requires a minimum deposit of $5, which is still relatively low but slightly higher than Exness.