ExnessIQ Option and IQ Option are two well-known brokers in the online trading industry, each serving different types of traders. Exness primarily focuses on forex and CFD trading, providing advanced tools and flexibility, while IQ Option is well-known for its binary options platform and simplified trading experience. This article compares these brokers in terms of trading platforms, trading toolscostDifferences in regulation and overall suitability for different traders.

The main features of Exness and IQ Options

Exness offers a wider range of forex pairs and cryptocurrencies, suitable for traders who wish to diversify their investments in both major and non mainstream markets. On the other hand, IQ Option has performed well in stock trading and options, attracting traders interested in simplified high-risk, high return tools.

| characteristic | Exness | IQ Option |

| Foreign exchange | 107+ | 40+ |

| Cryptocurrency | Bitcoin, Ethereum, 30+pairs | Bitcoin, Ethereum, 10+pairs |

| stock | 80+ | 170+ |

| index | thirteen | 10+ |

| goods | Gold, oil, silver | Gold, silver |

| option | Not Available | Binary, digital |

Trading Platform and Technology

Exness: Advanced tools provided for experienced traders

Exness provides access to Metatrader 4(MT4)And Metatrader 5 (MT5), these two are one of the most popular platforms in the industry. These platforms offer a wide range of analytical tools, algorithmic trading, and customizable charts to meet the needs of professional traders as well as those using advanced strategies such as scalping or hedging.

IQ Option: Beginner simplifies the experience

IQ Option's unique platform is user-friendly and visually appealing. It aims to make quick decisions, focusing on binary options and simple CFD trading. Although the versatility of this platform is not as good as MT4 or MT5, it is very suitable for beginners.

| characteristic | Exness (MT4/MT5) | IQ Option (proprietary) |

| TECHNICAL INDEX | 30+ | 15+ |

| Customizable charts | yes | limited |

| Algorithmic Trading | support | Not Supported |

| execution speed | Approximately 0.1 seconds | About 0.3 seconds |

Regulation and Safety

Exness regulation

Exness is regulated by multiple top financial regulatory agencies, demonstrating its commitment to global compliance and customer safety. These regulatory agencies enforce strict rules on fund segregation, transparency, and operational practices:

- The Cyprus Securities and Exchange Commission (CySEC):License number 178/12 allows Exness to operate within the European Economic Area (EEA) and is highly regulated.

- Financial Conduct Authority (FCA, UK):License number 730729 ensures compliance with strict UK standards, including investor compensation plans.

- Financial Services Authority (FSA, Seychelles):License number SD025 provides flexibility for global operations outside of Europe.

- Financial Conduct Authority (FSCA, South Africa):FSP number 51024 provides secure transactions for African clients within a recognized regulatory framework.

These licenses highlight Exness's ability to serve a diverse customer base while maintaining strong security and transparency.

The main characteristics of Exness regulation are:

- Customer fund isolation:Ensure that customer funds are separated from operating accounts to prevent misuse of funds.

- Negative balance protection:Ensure that traders do not lose more than the funds they deposit in volatile market conditions, providing additional security.

- Investor Compensation Plan:Under the protection of CySEC, qualified clients can receive up to 20000 euros in compensation in case of broker bankruptcy.

IQ Option regulation

IQ Option is regulated by the Cyprus Securities and Exchange Commission (CySEC) and holds license number 247/14. CySEC ensures compliance with EU financial standards, while IQ Option's regulatory scope is narrower compared to Exness.

CySEC regulations require IQ Option to adhere to the following key practices:

- Customer fund isolation:Similar to Exness, funds are stored separately from company assets.

- Investor Compensation Plan:Provide up to 20000 euros of protection for eligible clients to prevent brokerage failures.

- Regular Audit:Ensure operational transparency and financial stability.

Although CySEC's regulation provides a foundation of trust, the lack of regulation in other jurisdictions limits IQ Option's appeal to traders outside the European Union.

| aspect | Exness | IQ Option |

| Regulatory agencies | CySEC, FCA, FSA, FSCA | CySEC |

| Customer fund protection | SEGREGATION | SEGREGATION |

| Investor compensation | Up to 20000 euros (CySEC) | Up to 20000 euros (CySEC) |

| Global coverage | Widely covering Europe, the UK, and Africa | Limited to the European Union (CySEC jurisdiction) |

| Negative balance protection | 是 | 是 |

| Audit transparency | Multiple jurisdictions, frequent audits | Audit for the European Union |

Key points

- Regulatory coverage of Exness:Exness has multiple licenses from Europe, the UK, Africa, and other regions, providing global traders with more comprehensive security and broader market access.

- The narrow focus of IQ Option:Although CySEC regulation ensures compliance with EU standards, IQ Option's limited jurisdictional coverage may limit its appeal to traders from other regions.

- Customer protection function:Both brokers offer segregated accounts and investor compensation plans, ensuring a secure trading environment, but Exness stands out with its additional global safeguards.

This sound regulatory framework makes Exness the preferred choice for traders seeking enhanced security and wider market access, while IQ Option remains a simpler option for traders in the EU region.

Account type and accessibility

Exness account type

Exness offers multiple account options to meet different trading needs:

- Standard account:Suitable for beginners, no commission, low minimum deposit amount.

- Original spread account:Targeting professionals, we offer spreads starting from 0.0 points and fixed commissions.

- Zero account:95% of trading pairs have a spread of 0.0 points, which is very suitable for scalping trading.

- Professional account:Instant execution, tight spreads, suitable for experienced traders.

IQ Option account type

IQ Option provides a more simplified structure:

- Standard account:A minimum deposit of $10 is required to activate, and most trading tools are supported.

- VIP account:Suitable for larger deposits, providing better option returns and personal account manager services.

| characteristic | Exness | IQ Option |

| minimum deposit | 1 USD (Standard Account) | 10 USD (Standard Account) |

| Maximum leverage | infinite | 1:500 |

| Demo Account | Yes (unlimited) | Yes (unlimited) |

| No overnight interest option | available | Not Available |

Comparison of deposit and withdrawal processing

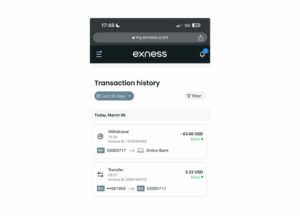

For traders who require quick access to funds, an efficient deposit and withdrawal system is essential. Both brokers offer multiple options, but Exness performs better in terms of processing speed and fee transparency.

Highlights of Exness Payment System

- Instant deposit and withdrawal:Most transactions are processed within seconds, including weekends.

- No hidden fees:Exness covers third-party transaction fees in most ways.

- Diversified payment methods:More than 80 payment methods including credit cards, e-wallets (such as Skrill, Neteller), and cryptocurrencies.

Highlights of IQ Option Payment System

- Medium processing speed:Withdrawals from standard accounts take 1-3 business days.

- Limited payment methods:There are approximately 15 payment methods, mainly bank cards and major electronic wallets.

- Costs of certain methods:Bank transfers and some card payments will incur withdrawal fees.

| characteristic | Exness | IQ Option |

| processing speed | Instant (most methods) | 1-3 working days |

| Withdrawal fee | 无 | Up to 2% in some methods |

| Payment Options | 80+ | Approximately 15 |

Costs and Expenses

Exness: Competitive pricing

Exness, with its competitive edgeSpreadStand out with transparent commissions:

- Spread:As low as 0.0 points on the original spread and zero account.

- commission:The original spread account is $3.50 per lot.

- Deposit/withdrawal fees:Most payment methods are free.

IQ Option: High potential return but higher cost

IQ Option fees:

- Spread:Usually higher than Exness, especially on Contracts for Difference (CFD).

- commission:Most transactions do not require payment, but are already included in a wider spread.

- Deposit and withdrawal fees:Some methods may charge fees.

| Expense Type | Exness | IQ Option |

| Spread (Euro/USD) | 0.1-1.1 spread | 1.0-2.5 spread |

| Commission per lot | 3.50 USD (Original Spread Account) | 无 |

| Deposit fees | 无 | Up to 2% |

| Withdrawal fee | 无 | variable |

Customer Support and Resources

Exness

Exness provides 24/7 multilingual support, including:

- Online chat, email, and phone.

- Comprehensive educational resources, including webinars, market analysis, and trading guides.

IQ Option

IQ Option provides:

- 24/7 customer support.

- Basic educational materials suitable for novice traders.

| aspect | Exness | IQ Option |

| Support availability | 24/7 | 24/5 |

| Supported languages | 15+ | 10+ |

| quality of education | Advanced Resources | Basic materials |

How do each broker handle volatility

Market fluctuations bring both challenges and opportunities. Brokers who excel in liquidity and execution speed enable traders to confidently exploit price fluctuations for profit.

Exness thrives in volatile markets, providing deep liquidity through Tier-1 providers and offering tools such as margin call notifications to protect traders from excessive losses. Its real-time analysis and execution infrastructure make it particularly suitable for active traders.

IQ Option simplifies volatility navigation through pre-defined risks in binary option products. Although suitable for cautious traders, its platform lacks the complex tools required for advanced market analysis during unpredictable market fluctuations.

Who should choose which broker?

Exness: Suitable for advanced and diversified traders

Exness is perfect for experienced traders looking for the following conditions:

- Access to the deep forex and CFD markets.

- Advanced tools and features for technical analysis and automation.

- SpreadCompact and low transaction costs.

IQ Option: Suitable for beginners and options enthusiasts

IQ Option is applicable to:

- Traders focus on binary options and simplified trading.

- Beginners looking for intuitive platforms require low deposits.

conclusion

Exness and IQ Option each have their own strengths. Exness provides advanced tools, competitive costs, and extensive market access for experienced traders, while IQ Option attracts beginners and binary option traders with its simplified platform. Your choice should depend on your trading objectives, preferred trading tools, and professional level.

Trade immediately with trusted broker Exness

Personally understand why Exness is the preferred broker for over 800000 traders and 64000 partners.

frequently asked questions

Which broker is more suitable for forex trading?

Exness is highly suitable for forex trading as it offers a wide selection of currency pairs (107+), low spreads, and advanced platforms such as MT4 and MT5.